Before digital assets, most efforts to create virtual currency relied on a central authority keeping track of transfers to decide if one person actually owned the money or had already spent it. The central government would double-check if the payer had the money they needed to use, preventing one of the most common types of fraud, known as double-spending.

Initially, bitcoins were shared bilaterally between enthusiasts, with bitcoins being exchanged for fiat currency. Thousands of cryptocurrencies have been introduced since then, and various exchanges have been developed to trade them.

The rapid development of encrypted coins and tokens (also known as “digital assets”) has spawned a thriving network of goods and services, including exchange platforms. Learn more down below!

What Is Digital Assets Exchange, and How Does It Work?

A digital asset exchange (DAX) or digital currency exchange (DCE) is an online company, such as Redot, that allows consumers to swap bitcoins or digital currencies for other assets such as fiat money by the government or other digital currencies.

Some digital currencies are backed by whole groups of real-world assets, such as precious metals (such as gold and platinum) and real estate stakes. Crypto exchanges typically provide a wide range of deposit and withdrawal solutions, such as PayPal and credit card transfers, bank wire transfer deposits and withdrawals, and other means of payment in return for cryptocurrency or digital assets.

A cryptocurrency exchange may also play the part of the market manager, taking the bid-ask spreads as a trade commission or charging fees for bid-ask matching services.

Background

In 2008, a paper titled “Bitcoin: A Peer-to-Peer Electronic Cash Scheme” was published under the pseudonym Satoshi Nakamoto, which described a decentralized system for exchanging money that is now known as “Bitcoin.” While Bitcoin was not the first effort to create a virtual currency, it was the first to attract traction and support.

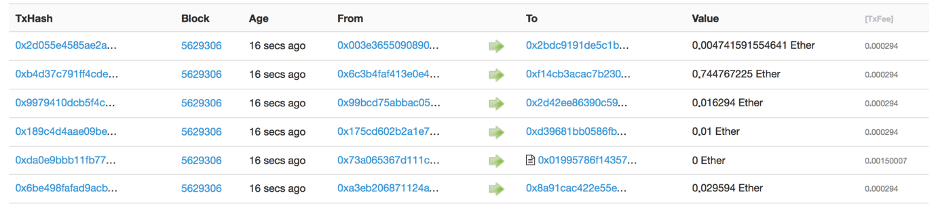

Bitcoin varies from its counterparts in that there is no central government in charge of the currency’s issuing or supply. Instead, every transaction is digitally registered in a code format. A ‘block’ is created from this coded exchange.

Any Bitcoin transaction block tracks who sent it, received it, and so on, and is openly viewable on an electronic, open, distributed, and public ledger. Think of it as a long sheet of paper with several copies that display every Bitcoin transaction and send and receive it.

The blockchain is a public ledger on which values are expressed by ‘tokens’ registered in Bitcoin transactions. Thousands of other coins have been released in the wake of Bitcoin throughout the last decade. Litecoin, Ethereum, and Ripple are only a few examples. The prevalence, price, extent of anonymity, and technical details of these altcoins vary.

Types of Digital Exchange Platforms

The different types of exchange platforms are:

1. Centralized and Decentralised Systems

Centralized system: A centralized cryptocurrency exchange is a forum where digital currencies can be bought and sold. A centralized cryptocurrency exchange is a forum where digital currencies can be bought and sold. Their transactions aren’t recorded on the blockchain.

You must apply your personal information for authentication in such exchanges. If you’re a corporation, on the other hand, you’ll need to supply the exchange with your corporate records so it can validate your account.

Your withdrawal limit will grow if you provide more information to these exchanges. In the event of a technological problem or forget their password, verified members of these sites should contact the exchange’s support staff.

In most cases, centralized crypto exchanges provide flat pairs at stable rates to their customers. Cryptocurrency users widely use these sites, and you can easily find one of them online. Examples include Binance, Coinbase, and LocalBitcoins.

Decentralized system: A DEX, or decentralized cryptocurrency exchange, is equivalent to a centralized cryptocurrency exchange in that it does not depend on a third party. The funds in this transaction are all deposited on the blockchain. Unlike the IOU-based mechanism used by a centralized crypto exchange, these platforms allow peer-to-peer (P2P) trading using funds, proxy tokens, or an escrow system.

2. Automated and Brokerage Models

Automated model: Crypto trading bots are computer programs to help you buy and sell cryptocurrencies at the best possible price. The primary aim of this software is to boost sales while lowering costs and risks. These apps allow you to access all of your cryptocurrency trading accounts in one location. Many of these applications make it easy to exchange for Ethereum, Litecoin, Bitcoin, and other cryptocurrencies.

Brokerage model: Brokers serve as matchmakers, connecting buyers and sellers and facilitating transactions. Business-to-business (B2B), business-to-consumer (B2C), and consumer-to-consumer (C2C) markets all use brokers. A broker usually charges a fee or commission for each deal that it facilitates.

3. Peer-to-Peer Platforms

Peer-to-peer exchanges are online marketplaces where individuals can share cryptocurrency directly with one another. They offer a technical forum for buyers and sellers to conclude trades according to their terms. They do not process fiat transfers or keep users’ funds in custody, unlike conventional exchanges. Because of their simple setup, they will run in almost every country and face far less scrutiny than traditional cryptocurrency exchanges.

4. Bulletin Boards

Bulletin boards are an essential part of end-to-end verifiable voting schemes that are cryptographically stable. The bulletin board is a storage device where all public election material is available for everyone to access, check, and audit.

The bulletin board in end-to-end verifiable voting systems provides the information needed to check that the election was conducted according to existing procedures, that the announced result is right, and that no interference by administrators or other agencies occurred.

Information such as public key and key generation data, polling activities and encrypted votes, decryption and count results, and mathematically verifiable proofs that any of the above are accurate are usually stored on the bulletin board. In most cases, the board also serves as an audit ledger, recording any significant events and actions anyone can review.

5. Fiat Gateways

A fiat gateway is a term you’ll hear a lot if you plan to get into cryptocurrency and buy Bitcoin or other cryptocurrencies via a crypto app. To comprehend its meaning and purpose, you must first comprehend the definition of fiat.

Fiat currency applies to national currencies issued by the government that is not backed by any asset. It comes from the Latin term fiat (from “facere”-to make/do, present passive subjunctive “let it be done”), and we may say it means “let it be done!”

Each network has its technology, products, and services and its regulatory status, jurisdictional scope, risk profile, and opportunities. Other applications and infrastructure levels are also available or in progress, either as stand-alone services or value-added services.