What Is Market Sizing?

I can feel sure about an idea, then get humbled when someone asks for the numbers.

Market sizing is the process of estimating how big a market opportunity is in customers, units, or revenue. I use it to decide if a plan is worth pursuing and what targets are realistic.

I treat market sizing as a way to turn uncertainty into a number I can defend.

What Is Market Sizing?

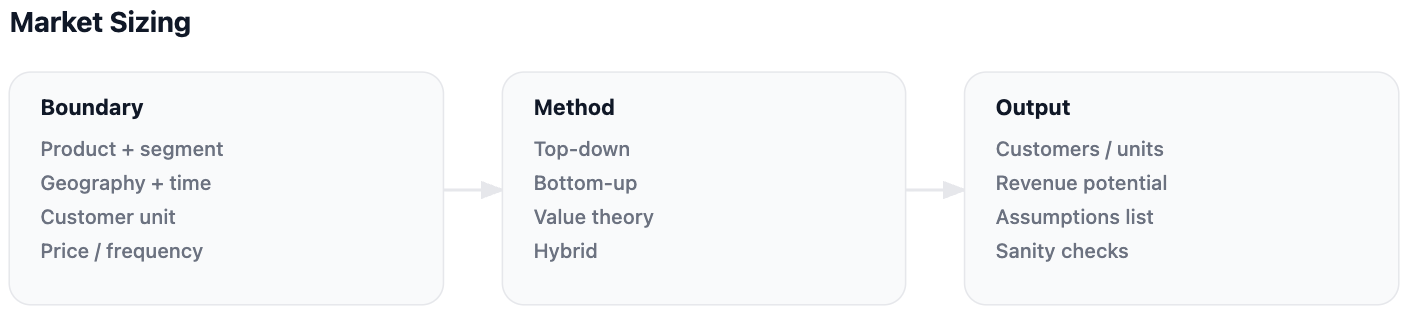

Market sizing is a structured estimate of total demand in a defined market, built from assumptions I can explain. It is not a perfect answer. It is a decision tool. When I size a market, I am not trying to predict the future with precision. I am trying to avoid two common traps: building in a market that is too small, or planning as if I can capture demand that I cannot reach. The “sizing” part matters because markets feel infinite when I talk in general terms. The moment I define boundaries and do the math, I see what is real.

I always start by defining the boundary, because market sizing without a boundary is just storytelling:

(1) What exactly is being sold? (product category + use case)

(2) Who is buying? (customer type + segment)

(3) Where are they? (geography)

(4) When does demand happen? (time window, usually annual)

(5) What is the unit? (customers, transactions, seats, or revenue)

This is similar to how I like to work on voicesfromtheblogs.com. I listen to messy market “voices” and translate them into the Three-Voices Framework—Market, People, Strategist. Market sizing is one of the cleanest “Strategist outputs” I can create: one number with clear assumptions.

Why Is Market Sizing Important?

Market sizing is important because it shapes strategy, budget, and what “winning” can realistically look like. I have seen founders and teams chase goals that sounded reasonable in words but were impossible in math. I have also seen teams ignore markets that looked “small” until sizing revealed a strong, profitable niche. Market sizing keeps me honest about tradeoffs. If the market is huge but crowded, I likely need sharper positioning and distribution. If the market is smaller but underserved, I can win with focus and great execution.

Market sizing helps me answer questions that matter early:

(1) Is this opportunity big enough to justify the effort?

(2) Which segment should I enter first?

(3) What revenue target is realistic for year one?

(4) How many customers do I need to hit the plan?

(5) How much can I spend to acquire a customer?

I also like it because it forces better thinking. I must state assumptions. That makes disagreement productive. People can argue about inputs, not vibes.

How Do I Do Market Sizing?

I do market sizing by choosing a sizing approach, building a simple model, and checking it against reality. The math should be simple enough to explain on one slide.

Step 1: Define The Market In One Sentence

I start with a one-sentence market definition that includes who, what, where, and time. Example structure:

(1) “[Product] for [customer segment] in [geography] per [year].”

If I cannot write this sentence, my sizing will drift and inflate.

Step 2: Choose The Sizing Unit

I choose whether I will size by customers, transactions, seats, or revenue. The unit depends on what I sell. For a subscription, customers and annual revenue work well. For a marketplace, transactions might work better. For enterprise software, seats or accounts might be clearer.

Step 3: Pick A Method

I pick a method—top-down, bottom-up, or value theory—based on what evidence I can access. I often start with bottom-up, then use top-down as a sanity check, not the other way around.

What Are The Main Market Sizing Methods?

The main market sizing methods are top-down, bottom-up, value theory, and hybrid sizing. Each one has a strength and a common failure mode.

What Is Top-Down Market Sizing?

Top-down market sizing starts with an external market total, then narrows it using filters. The advantage is speed. The risk is fake precision. Filters can be arbitrary. If I use top-down, I keep filters conservative and visible. I do not stack five weak filters and act confident.

I use top-down mainly to answer: “Is my bottom-up number wildly off?”

What Is Bottom-Up Market Sizing?

Bottom-up market sizing builds the market from real units: number of buyers × spend per buyer. This is my favorite method because it forces realism. I must define who buys and how much they pay. If I cannot estimate those, I do not actually understand the market.

A simple bottom-up model looks like:

(1) total target customers in boundary

(2) % that has the need now

(3) % that can be reached by my channels

(4) annual spend per customer

(5) multiply to estimate annual revenue potential

This method makes it clear where I am guessing. It also connects directly to go-to-market planning.

What Is Value-Theory Market Sizing?

Value-theory sizing estimates market size based on the value created and what share of that value customers will pay. I use this when pricing is not standardized or when the product saves measurable money or time. I estimate value per customer, estimate realistic willingness to pay, then multiply by the number of customers with that problem. The risk is exaggerating value. So I keep the value estimate conservative and I note what evidence would validate it.

What Is Hybrid Market Sizing?

Hybrid sizing combines methods so one method checks the other. I like hybrid sizing when the market is messy. I may do bottom-up for a target segment and top-down for a sanity check. If the numbers are far apart, I revisit assumptions.

What Are The Best Sanity Checks For Market Sizing?

The best sanity checks are simple comparisons that reveal impossible assumptions. I do not need fancy models to catch bad sizing. I use checks like:

(1) Implied customer count: does it exceed plausible buyers in the region?

(2) Implied spend: is annual spend per customer realistic for this category?

(3) Channel capacity: can my distribution reach enough people to matter?

(4) Competitive reality: do competitors’ known scale and pricing fit my estimate?

(5) Time realism: can customers actually buy at the frequency I assumed?

I also check whether my model accidentally includes people with no intent. Many “huge” market sizes are just population numbers, not demand.

What Are Common Market Sizing Mistakes?

Common mistakes are sizing too broadly, confusing TAM with reachable revenue, and hiding assumptions. I see these errors the most:

(1) using “everyone” as the market

(2) using the total category spend as if it is all available to me

(3) mixing time windows (monthly vs yearly)

(4) assuming perfect conversion or perfect distribution

(5) treating one number as fact instead of an estimate

(6) skipping the “do nothing” alternative in adoption assumptions

If I avoid these, my market sizing becomes useful even if it is not perfect.

Conclusion

Market sizing estimates how big an opportunity is using clear boundaries, simple math, and honest assumptions.