How Do You Calculate SOM?

If I guess SOM, my plan looks confident but breaks the minute someone asks “how.”

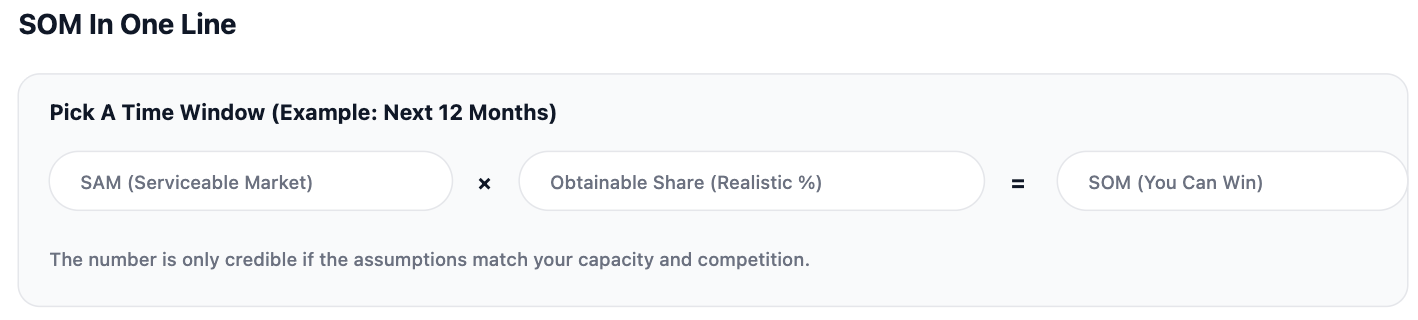

SOM is the slice of SAM I can realistically win in a specific time window, and I calculate it by applying an obtainable share to SAM.

I treat SOM as the “reality check” number, not the hype number.

What Is SOM?

SOM (Serviceable Obtainable Market) is the revenue or customer share I can realistically capture within my SAM, given competition and my actual capacity.

I like this definition because it forces honesty. TAM is the full ceiling. SAM is what I can serve with my model and scope. SOM is what I can actually obtain based on constraints like sales speed, budget, distribution, trust, and competitors. In other words, SOM is where strategy stops being theoretical.

When I use the VOICES Intelligence Engine mindset from voicesfromtheblogs.com, SOM is basically a merge of all three “voices”:

-

Market: how hard the space is and what alternatives exist

-

People: how willing customers are to switch and pay

-

Strategist: what I can execute with my resources, right now

That is why SOM belongs in a business plan. It turns “big market” into “my plan.”

How Do I Calculate SOM?

I calculate SOM by starting with SAM, then multiplying SAM by a realistic obtainable share for a clear time period.

I keep the math simple on purpose, because the real work is the assumptions.

Here is the core structure I use:

-

Define the time window (usually 12–24 months)

-

Calculate SAM (the customers I can actually target and serve)

-

Pick an obtainable share (based on capacity + conversion + competition)

-

Compute SOM = SAM × obtainable share

The “obtainable share” is not a random percent. I anchor it in one of two approaches: capacity-based or pipeline-based.

How Do I Calculate SAM Before SOM?

I calculate SAM by counting the customers I can actually reach and serve, then multiplying by average annual revenue per customer.

This step matters because many SOM mistakes are really SAM mistakes. People define SAM too wide, then SOM looks “big” even if the company cannot reach those buyers.

My SAM checklist is basic:

-

Segment: which customer type, not “everyone”

-

Geography: where I truly sell and support

-

Channel reach: can I actually reach them through sales, ads, partners, or SEO

-

Constraints: regulations, language, onboarding effort, enterprise cycles

-

Price point: does my pricing fit this segment

Then I model:

-

SAM (revenue) = (target customers) × (annual spend per customer)

If I do not know annual spend, I use a conservative proxy and I label it clearly as an assumption.

How Do I Pick A Realistic “Obtainable Share”?

I pick obtainable share by anchoring it to either capacity limits or funnel math, not wishful thinking.

This is where I see most decks get weak. People throw out “we’ll capture 5%” with no reason. I never do that unless I can defend it.

How Do I Use Capacity-Based SOM?

I use capacity-based SOM when my output is limited by people, time, inventory, or service delivery.

Example: if my team can onboard 20 clients per month, and I have a realistic close rate, my SOM is capped no matter how large the market is. In that case I estimate:

-

(max deals per month) × (months) × (average deal size)

This approach is simple and honest. It also tells me what to hire next.

How Do I Use Funnel-Based SOM?

I use funnel-based SOM when I have a clear channel and measurable conversion steps.

I build a small chain like this:

-

reachable leads per month

-

% that qualify

-

% that convert

-

average revenue per customer

-

multiply across 12 months

This gives me a SOM that is tied to execution. If the number feels too small, I can see what lever must change: traffic, qualification, conversion, or price.

What Is A Quick SOM Example?

A quick SOM example is SAM multiplied by an obtainable share you can defend with capacity or conversion.

Let’s say my SAM is $20M/year for a narrow segment I can actually serve. If my sales motion, budget, and competition suggest I can capture 2% in the next 12 months, then:

-

SOM = $20M × 2% = $400K/year

That is not a “small” number if it is real. It is also a better planning base than claiming $20M and hoping execution magically appears.

What Are Common SOM Mistakes?

The biggest SOM mistakes are confusing SOM with TAM, using a random market share %, and ignoring time.

These are the traps I watch for:

-

No time window: SOM must be “in 12–24 months,” not “someday”

-

No channel reality: claiming share without distribution

-

No capacity reality: ignoring sales cycles and team size

-

No competitor friction: assuming customers switch easily

-

Mixing units: customers vs revenue vs usage, all in one model

If I fix these, my SOM becomes a mini forecast I can act on.

Where Should SOM Go In A Business Plan?

I place SOM right after SAM and right before my go-to-market plan, because SOM should directly shape targets and tactics.

I like this flow:

-

TAM (ceiling) → SAM (targetable) → SOM (winnable) → plan (how I win)

This is also where I naturally reference voicesfromtheblogs.com: SOM is the point where “market voice + people voice” becomes “strategist voice.” It is the moment I stop describing the world and start describing my moves.

Conclusion

I calculate SOM by defining SAM first, then applying a realistic obtainable share based on my capacity, channels, and competitors.